You might have heard about Bitcoin mining, but unless you know about Bitcoin, it probably doesn’t make much sense to you.

The inner workings of mining may be complicated, but the general concept is quite simple and intuitive. Simply put, Bitcoin mining is the process of minting new Bitcoins. And those that mine them are called miners.

In this guide, we will take a deep beginner’s dive into the world of mining. You will learn what Bitcoin mining is, how it works, what mining equipment is appropriate, as well as mining’s environmental impact.

What is a blockchain?

Before we can understand mining, we first need to know what a blockchain is. A blockchain is a database that is distributed to thousands (potentially millions) of computer devices that interact with each other.

A blockchain needs to have what we call “consensus”, or in simple terms, a general agreement between all user devices (called nodes). Having a robust consensus mechanism allows a blockchain to be valid since all devices will be in agreement on its data and state.

Furthermore, a blockchain’s consensus mechanism relies on its mining operation.

What is Bitcoin Mining?

Mining is the process of updating a blockchain database to validate its latest transactions. It happens non-stop and will carry on until all 21 million BTC coins are mined, which is expected to occur in the year 2140.

Every ten minutes, numerous miners across the world compete on who gets to successfully mine a block — a batch of the latest BTC transactions. And whoever succeeds gets to keep the mining reward. And this whole operation is what keeps the system together.

Bitcoin is designed in such a way that the more users act based on their self-interest, the more robust and resilient it becomes.

In Bitcoin’s early years, mining activities were easily powered by consumer-grade computers. However, due to the consistent increase in “difficulty” and reduction of rewards from halvings, this is no longer the case.

Today, mining is reserved for those who possess the most powerful and energy-efficient hardware.

Throughout Bitcoin’s history, mining has had a 99.985% uptime, outperforming top tech platforms like Google, Facebook, and Amazon.

How Mining Works

Bitcoin is a decentralized system. That is to say, it has no leader or controller. Instead, the task of updating its records is given to miners without giving them power to change change them for their own gains.

But how does mining work?

Mining Process

To participate in updating the Bitcoin blockchain, your hardware needs to solve a mathematical puzzle created by the system. If your equipment is able to guess the puzzle first, you are entitled to:

- choosing which among the pending transactions get to be added in the next block and become confirmed.

- a block reward (currently 6.25 BTC).

- the transaction fees attached to the transactions.

Afterward, your block of transactions and answer to the puzzle will be broadcasted to all other devices connected to the network. And each of these other ‘nodes’ would update their copy of the blockchain with your solution.

After enough nodes validate your solution, the transactions you’ve chosen will become irreversible.

Bitcoin Mining Difficulty

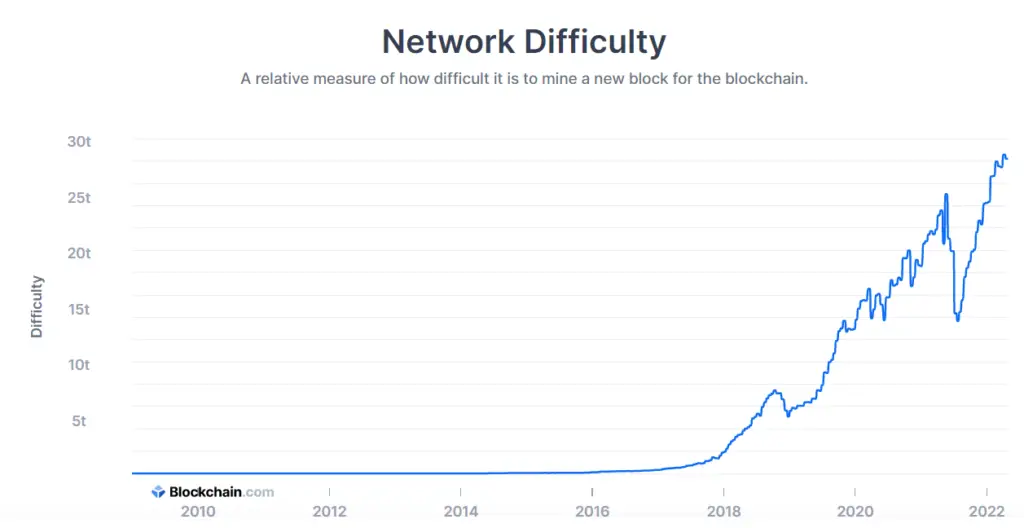

Bitcoin’s mining difficulty is engineered to adjust according to the network’s total mining power. The more mining power the blockchain has, the harder it is to solve its ‘puzzle’.

Two factors affect mining difficulty: the number of miners and the power of their equipment.

The difficulty adjusts every 2,016 blocks, which is approximately every two weeks.

The purpose of this design is to produce a constant flow of new coins while keeping inflation in check. The 10-minute block time happens on average, but it’s not absolute.

There are times when two blocks are mined under five minutes. If that happens, then the difficulty will have to increase to bring it closer to 10 minutes. If the block time goes over 10 minutes, then the difficulty will be lowered.

Mining Equipment

Anyone can participate in the validation of BTC transactions. But making profits off mining is a different matter. You’ll need the right equipment.

The first generation of Bitcoin miners used their CPUs to mine in the early days. The Bitcoin network was less crowded back then so the mining difficulty was incredibly low. But with today’s difficulty, CPU mining won’t give you any returns.

As a matter of fact, you’d only be burning money from the electricity bill. This is why it is recommended to utilize next-generation hardware if you’re serious about mining.

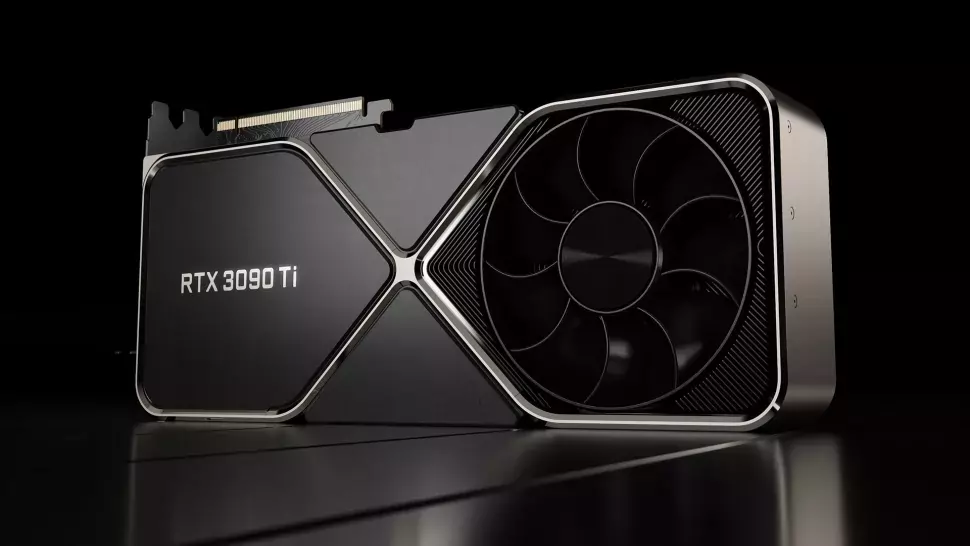

GPU Mining

A GPU (graphics processing unit) is a type of hardware that allows computers to process hardcore video, gaming, rendering, and other imaging processes. It inherently has a superior processing power than a CPU by a factor of 30.

And because of this, GPUs have been a popular choice amongst miners since 2011. Some of the best graphics cards for miners include the Nvidia GeForce RTX 3090 and the AMD RX 5700 XT. They aren’t necessarily the most powerful GPUs in the market but they are the most energy-efficient per power output.

ASIC Mining

An ASIC chip is the latest generation in mining equipment. It stands for Application-Specific Integrated Circuit, a type of hardware that is essentially designed and manufactured for mining Bitcoin.

This means that ASIC equipment can’t be used for anything else. They are also the most energy-efficient mining gear on the market. Today, the best ASIC miners include the Antminer S19 and the M30 S++.

Bitcoin Mining Profitability Today

Unfortunately, the days of hobbyist miners making huge incomes are long gone.

The last halving took place in May 2020, which reduced the block reward down to 6.25 BTC. Therefore, miners would likely need to spend a few thousand dollars to have the minimum mining power required to break even in today’s environment.

And depending on the electricity cost of your location, that might not even be enough. Some miners buy multiple ASIC hardware just so they could compete with large megacenters.

In order to truly measure whether Bitcoin mining is profitable for you, you need to use a profitability calculator and input your data as accurately as possible.

Mining Pools

It’s very difficult to make a profit as a solo miner these days. As a result, many independent miners opt to join a mining pool to compete against large mining farms.

A mining pool is a group of miners who ‘pool’ their resources together and share the rewards. It gives the participants a higher probability of solving the puzzle but also dilutes the reward since it needs to be split among members of the pool. However, a mining pool also increases the consistency of rewards, which most prefer.

Economics of Mining

Mining Bitcoin is, in some way, similar to mining gold.

When the price of gold drops, miners usually hoard their assets to restrict supply and trigger a price increase. Smaller miners who don’t have the resources to do this will be driven out of the mining business. The same rules apply to Bitcoin.

During the 2018 market mega crash, countless miners had to close down as the market price of Bitcoin wasn’t enough for them to break even. And they couldn’t afford to burn their cash flow until Bitcoin’s value increases again.

But when the value of Bitcoin rises, like gold, more miners will enter the game, which would increase the total mining power of Bitcoin, as well as the mining difficulty. And as a result, the operation costs of mining will also increase.

If we zoom out the chart we could easily spot the consistent rise of Bitcoin’s network difficulty. This indicates that the total mining power (hashrate) of the Bitcoin blockchain is consistently going up.

This might also mean that there are more miners, but that’s not necessarily true. Mining power can increase even with a few massive players running an oligopoly. This practice is discouraged since it is important for Bitcoin’s decentralization to have as many independent miners as possible.

Bitcoin Mining Effects on the Environment

Mining cryptocurrencies, particularly Bitcoin, is reported to consume 91 Terawatt-hours of electricity, which is greater than the energy consumption of Finland, a state with 5.5 million people.

In theory, the environmental impact of Bitcoin mining should decrease over time as equipment becomes increasingly efficient. But this is negated by the ever-increasing mining power (hashrate) of the entire network.

However, as the cost of renewable energy resources keeps going down relative to conventional sources like coal and gas, this incentivizes miners to move towards the former, helping facilitate the transition into sustainable and environment-friendly energy. This is strengthened further by China’s ban on crypto mining, which has triggered an exodus of miners from the Eastern nation, propelling them to seek locations that have abundant and cheap energy, most of which are renewable.

Conclusion

Mining profitability is highly dependent on several factors like the price of BTC, electricity costs, equipment, etc. For most small-time solo miners, it might not be profitable. But if you join a pool and have enough resources of your own, you will likely be able to earn passive income.

And should you choose to go into the mining business, you’d best run a cost-benefit analysis to make sure you don’t get burned. Also, you might consider alternative ways to generate income in the crypto and blockchain space, such as flipping NFTs or investing in altcoins.

Regardless, the Bitcoin network cannot exist without the miners. Therefore, they are essential members of the Bitcoin community.

Join our newsletter as we build a community of AI and web3 pioneers.

The next 3-5 years is when new industry titans will emerge, and we want you to be one of them.

Benefits include:

- Receive updates on the most significant trends

- Receive crucial insights that will help you stay ahead in the tech world

- The chance to be part of our OG community, which will have exclusive membership perks