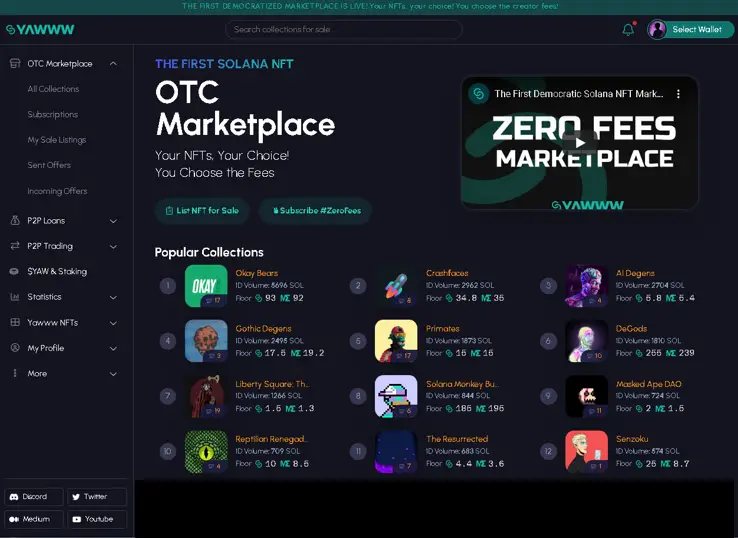

The Yawww platform caused some controversy after announcing its upgrade from a mere P2P NFT trading platform to a full-blown marketplace because of one primary reason: it allows NFT traders to bypass the royalty fees embedded in smart contracts, allowing them to sell their NFTs without giving a cut to the original creators.

This has become quite controversial since:

- many acknowledged that most royalty fees of NFT projects on Solana have been set too high,

- many also see this as a way to prevent artists from making money from secondary sales,

- some believe that many NFT projects might fail because of this solution.

As for Yawww, it simply found an opportunity to become one of the dominant non-fungible token (NFT) platforms on Solana by implementing a hybrid of peer-to-peer (P2P) lending and NFT marketplaces. While traditional P2P lending platforms have previously existed and enabled this feature, traders always had the burden of finding a good deal and trustworthy individuals. The Yawww platform simply created a system that automates this.

What is Yawww?

Yawww is an automated P2P trading marketplace on the Solana blockchain that offers a safe place for lenders and borrowers to conduct NFT trading transactions. One notable thing about this project is that it only charges a minimum (without any creator fees), which keeps the transactions as cheap as possible for NFT traders.

This service uses Solana smart contracts to offer collateralized loans for borrowers and legitimate security for lenders. Yawww allows both parties to negotiate their loan terms to help them get the most beneficial deal.

The team aims to let Yawww grow organically and evolve as a self-regulating lending/trading ecosystem with little to no user restrictions. But several limitations will still exist to protect the greater interest of Yaww users, digital artists, and the entire NFT community.

How Does Yawww NFT P2P Loan Works?

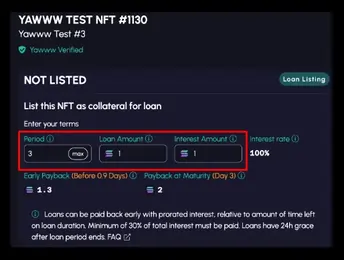

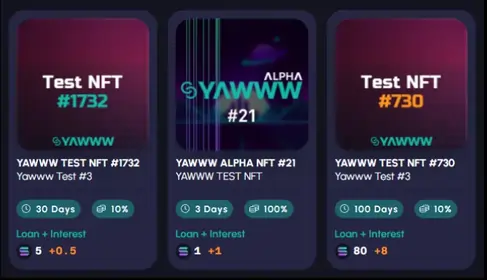

Yawww allows two anonymous individuals to initiate and approve loan transactions quickly and easily. A borrower simply has to post a Solana NFT as loan collateral, which the system will transfer to an escrow account for safekeeping. Apart from the NFT, a borrower’s loan request must include the loan amount, the interest rate, and duration.

This simple process allows thousands of willing lenders worldwide to immediately pick a borrower to fund. Both parties may negotiate the terms through a private chat before approving the transaction.

This system offers borrowers instant liquidity without requiring them to sell an asset, but they risk losing their collateralized NFTs once they miss the loan payment deadline. Lenders, meanwhile, gain security and profits through a collateralized NFT, interest rates, and in some cases, new assets due to borrowers’ deferred payments.

How to Apply for a Loan on Yawww (For Borrowers)

In case

Step 1) Connect Your Wallet And Select “Create A Loan Listing”

Step 2) Select The NFT You Want To List As Collateral

Step 3) Set The Terms Of The Loan

Enter your preferred loan duration, loan amount, and the interest you’re willing to pay.

Step 4) Check The Terms Of The Loan And Select “List For Loan”

Note: Carefully check all the information you’ve entered before approving your NFT for listing. Another important reminder is that Yawww offers a 24-hour grace period from the time of loan expiration.

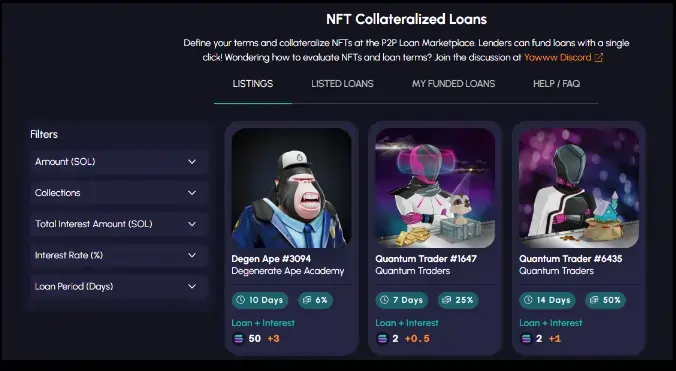

How to Lend on Yawww and Earn Interest (For Lenders)

The Yawww platform enables you to fund a loan in order to earn interest. These are the steps required.

Step 1) Connect Your Wallet And Select “Loan Listings”

Step 2) Review The Offers And Click Your Preferred Loan Listing

Step 3) Review The Offer’s Complete Details

Note: Please check the important details such as period, interest, and APY (annual percentage yield).

Terminologies you need to keep in mind:

| Loan Amount | The fund you’ll supply for the loan. |

| Interest Amount | The profit you’ll gain once the loan duration ends |

| Early Payback | The minimum SOL you’ll receive once a borrower pays early. |

| Payback at Maturity | The total amount you’ll receive (The amount you’ve paid to fund a loan + interest) |

Step 4) Approve the Loan

After checking all the details, click the ticker box and select the “Fund the Loan” button.

Step 5) When a borrower fails to pay the loan, claim the collateralized NFT by going to “My Funded Loans”

How to Purchase an NFT on Yawww (For Buyers)

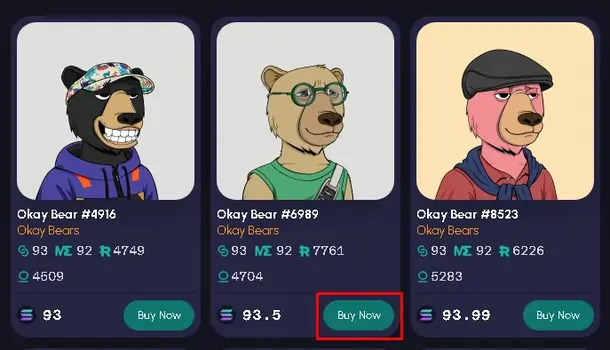

Step 1) Connect Your Wallet And Search For Your Preferred Nft Collection

Head over to the search bar and type the collection of the NFT you are interested in buying.

Step 2) Select an NFT and Click “Buy Now”

Let’s say we’re looking to buy some Okay Bears, for example.

Step 3) Approve The Transaction On Your Wallet

Once everything is done, click Approve on your wallet.

Advice for Lenders

The platform also protects lenders from potentially disadvantageous deals by offering a tool called the loan-to-floor (LTF) metric. It determines when a borrower’s asking price is much higher than a collection’s floor price. While a high LTF does not always mean that an offer is a bad deal, having an indicator gives a lender with additional data to decide whether to fund a loan or not.

The team has also advised lenders to ask themselves two critical questions before funding a loan. These questions are: “Would they be satisfied once the loan has been paid back (plus interest)“? and “Would they be happy when they acquire the collateralized NFT once the borrower deferred on the payment?” If they’ve answered “yes” to both of these questions, then the loan offer is a good deal (and not a waste of time and money).

Yawww Does Not Verify 1:1 Art Projects.

While Yawww will verify “unknown” yet legitimate NFT projects, it is clear that the platform won’t approve 1:1 NFTs. The team recognizes that 1:1 artists earn a large chunk from the aftermarket, which is critical to their career and future ventures.

And to offer fair and balanced opportunities for everyone, Yaww decided to prohibit verifying 1:1 art projects and let 1:1 specialized platforms such as “exchange.art” handle this specific transaction.

How does Yawww Stand Out from the Competition?

Current NFT lending services (which remain very few) use automated lending pools to offer instant liquidity for users, which is a highly beneficial feature. But the downside is that they only offer low LTVs (loan-to-value) ratio, which usually comes with short durations and high interests, creating a disadvantage for borrowers. These offerings protect lending platforms from being exposed to high risks but create limited opportunities for users.

Yawww eliminates these centralized agreements and allows both parties to negotiate on their preferred terms to get the most out of their deals. Borrowers can even receive bigger LTVs with longer durations through privatized negotiations.

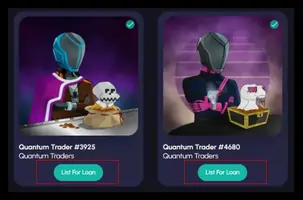

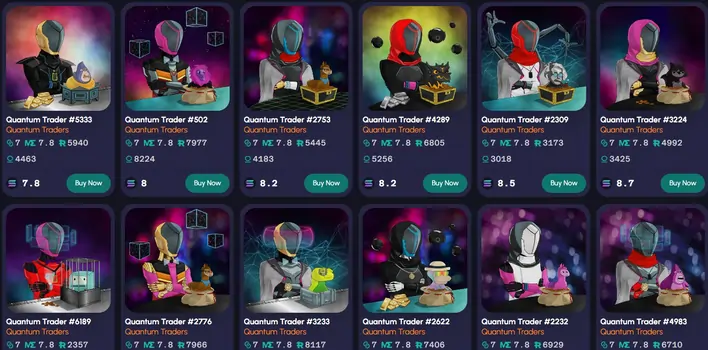

What are Quantum Traders and Solstein NFTs?

Quantum Traders is Yawww’s 8,888 NFT collection of faceless alien androids on a mission to protect the ecosystem from scammers and stabilize its economy using the $YAW token. In its lore, Yawww’s first NFT collection, a band of 2,222 NFT scientists called “SolSteins” have summoned these aliens to fulfill their critical mission.

Yawww has found out that Quantum Traders NFTs were used chiefly as loan collateral, which the team already anticipated since SolStein holders were the first to know about Yawww’s then-upcoming lending service. As for the top Solana collection used for loan collateral, the recognition goes to the DeGods collection, which is arguably the most popular NFT project in all of Solana.

The team intends to bring Quantum Traders and SolSteins under a major rebranding and merge the two NFTs, which can potentially bring exponential value to current and future Yawww digital asset holders.

YAW Token

$YAW is the platform’s deflationary token, supported by 50% of Yawww’s entire revenue, and will soon evolve as a governance token. Holders can stake their YAW tokens for two years, from April 24, 2022, to April 24, 2024. Users will also get a 33% discount on transactions (including loans) when they use $YAW instead of SOL tokens.

Moreover, SolStein and Quantum Traders serve as “vessels” for the token as these two collections emit $YAW token emissions to holders, which they can claim daily for two years. There is a fixed amount of tokens for each NFT, which will automatically and gradually decrease whether holders stake their digital assets or not. They also have the option to unstake their NFTs anytime.

The two collections will still play a big role in the Yawww ecosystem even after their token emissions have ended. The team plans to integrate key features on the NFTs, which will allow holders to access exclusive and premium offerings. The platform also offers $YAW holders two ways to increase their token’s yield: through $YAW-$USDC pairing on Raydium and single-sided $YAW staking.

Furthermore, Yawww has rolled out a feature called “subscription by staking,” which offers users perks, including benefits and discounts on lending and trading transactions for its platform. The team sees the subscription-thru-staking feature as a more convenient and economical way for users to interact smoothly with the platform, rather than letting them pay $YAW tokens for every transaction.

Join our newsletter as we build a community of AI and web3 pioneers.

The next 3-5 years is when new industry titans will emerge, and we want you to be one of them.

Benefits include:

- Receive updates on the most significant trends

- Receive crucial insights that will help you stay ahead in the tech world

- The chance to be part of our OG community, which will have exclusive membership perks