It’s interesting to note that Solana went live in March 2020, at a critical time when the global pandemic was just about to change our history forever. Call it symbolic, but this blockchain platform has shown resilience, being born at such a perilous time. And when it came out, it caught the world’s attention when it delivered something that even the world’s largest layer-1 blockchain couldn’t: high speed and low costs.

But some may argue that there are multiple blockchains that can do the same. However, they weren’t able to scale to the same level Solana has, nor have they attracted enough developers to create a vibrant ecosystem that could challenge even Ethereum. In fact, SOL is one of the so-called ‘Ethereum killers’, although that title is currently being questioned.

But while it has grown so much as a blockchain platform, with an active ecosystem, breakthrough decentralized applications (dApps), and countless promising projects, Solana’s shine, it seems, is being eclipsed by questions and controversies.

In this article, we will have a deep dive into its potential and limitations; and address the controversies surrounding it. But above all, we aim to help you answer the web3 community’s million-dollar question:

“Is SOL still worth it?”

What is Solana?

Solana is a fast, cheap, and scalable blockchain network that boasts an average speed of 2K-4K transactions per second (tps) and a typical transaction cost of $0.00025. It combines the efficiency of the proof-of-stake (PoS) consensus mechanism and proof-of-history (PoH), a cryptographic delay function that adds timestamps to the process, to maintain a decentralized network.

The Ethereum rival currently hosts non-fungible tokens (NFTs) and marketplaces, decentralized finance (DeFi) projects like lending protocols and decentralized exchanges (DEXs), as well as various other web3 applications. Apart from using the network’s thousands of dApps, you may also participate in securing SOL by becoming a validator or a staker, which allows you to earn passive income.

Moreover, it is a Layer-1 blockchain, meaning, it is a standalone decentralized network that manages its own on-chain and off-chain transactions. It is (not) a supporting protocol to a bigger blockchain like Polygon and Immutable X (called Layer 2s). In fact, Solana stands as one of the few blockchains that actually scales on-chain the moment it was launched, an impressive and unique feat.

SOL

SOL is the native token of the Solana blockchain that is primarily used to pay transaction fees and reward validators and stakers for securing the network. Since Solana is decentralized, it needs a distributed consensus and a reward mechanism to maintain its network. SOL addresses that.

Sub-50K TPS Limit

You might have noticed that we mentioned earlier that SOL has an average tps range between 2k-4k. But do you know that its billed transaction speed is actually 50K tps? Actually, it claims that it could go further to 65K tps.

This is important because tps (along with finality) is an important scaling attribute that allows for fast and low-cost transactions.

Yet, when you check the stats on its website, you’ll find it averaging around the 3k level.

Is Solana misleading people about its real tps? With all the congestion users are facing, many are wondering whether that 50K tps is actually an intentionally false claim.

The truth is, there are various reasons for the network’s seeming (in)capacity to reach its desired speed. But we’re not totally dismissing the protocol’s capacity to reach this limit. In fact, it has already reached this 50k transaction per second speed on its testnet, but it was in a controlled environment. We have yet to see SOL can replicate this feat in the mainnet, which is full of unpredictable variables.

Another way to view SOL’s transaction speed issue is that the network may have been designed from the ground up to reach this capacity. But it might take some time to complete all the necessary infrastructure to support this capability. Since Solana is a continuously evolving platform, developers may gradually include key aspects to the network to power this.

In comparison, Ethereum launched in 2015 and has yet to come close to Solana’s scalability level, at least on-chain.

Right now, Solana remains under a 4K tps capacity, a stark fraction of its promised 50K tps. Only time will tell if the protocol can really pull it off, or if another layer-1 chain might swoop in first.

What Advantages Does Solana Have Over Other L1 Blockchains

Solana is not called a high-performance blockchain for no reason.

Fast Transaction Settlements

Solana is arguably one of the fastest blockchains of 2022, which is the primary reason why hordes of developers flocked into its ecosystem last year. While it may not have reached its billed speed, 4k tps is nothing to scoff at. If you compare that with Ethereum pre-merge, which was at an average of 15 tps, that is over 250x higher.

However, this doesn’t mean that Solana is fully scaled, as transaction speed still heavily depends on multiple aspects, including network demand and the amount of spam infesting the platform.

Negligible Transaction Costs

Solana maintains a transaction cost of less than $0.001, which users and developers can both enjoy. In any currency conversion, this cost should be cheap for everyone, regardless of their country. This is the primary reason why many users have migrated to Solana from Ethereum.

Built on Rust

Unethical developers are one of the rising problems in web3, especially the so-called “copypastas,” who merely clone existing projects and build them on another blockchain. Think of it as the plagiarism of the coding world, but since blockchain protocols are open source, it doesn’t apply.

As a solution, it has selected Rust as its programming language to repel away these soggy copypastas from potentially launching low-quality projects. But how?

Rust is a challenging but rewarding programming language to learn as it is quite complex but also high-performance. The founders of Solana actually acknowledged that they chose Rust for this very reason, as EVM-compatible smart contracts are prone to be used by unethical and passionless programmers since they could easily clone Ethereum dapps.

This is also why the protocol has passed on Solidity, an established programming language used by the blockchain giant Ethereum. While the programming language is indeed solid in its performance, the founders believe that it wouldn’t attract as many “smart people”.

Other advantages of Rust include:

- Advanced optimizations,

- Access to ecosystem support for free,

- Minimal runtime, and;

- Top-to-bottom support on WebAssembly.

Environmental Sustainability

As mentioned before, Solana uses an eco-friendly consensus mechanism, PoS, which uses significantly less energy than the power-hungry proof-of-work used by Bitcoin and Ethereum (pre-Merge). Moreover, the network also achieved carbon neutrality in 2021 through its carbon-offsetting efforts that ensure its zero negative impact on the environment.

What are the Disadvantages of Solana

Alas, Solana is not without its flaws. Let’s explore some of the issues the hold back the L1 network today.

Outage Problem

Communities from rival networks sometimes throw jabs at Solana, calling it the only blockchain with an “on- and off-switch.” Note that this is technically false, but has spread like wildfire, nonetheless. No blockchain has an off-switch because they don’t work like that.

Well, it’s actually an inside joke in Ethereum circles (perhaps in Cardano too) alluding to SOL’s outages (more than six times already) and the response of the Solana Status Twitter account, which provides status updates on the protocol. It later blew up into a meme.

This dig on Solana alludes to the fact that it allegedly has fewer decision-makers (block producers) compared to other web3 protocols, making it easy to agree on a critical decision (in this case, the restarting of the blockchain). But while it may sound convenient, it is a sign of centralization in the ecosystem, which counters the primary aim of blockchain protocols, which is to be decentralized.

Now, you may be wondering, what exactly took down a well-known blockchain like Solana multiple times? There’s got to be a reason, right? Yes. And let’s take a deep dive into these things.

Upon investigation, it turned out that excessive inbound transactions on the network were the primary reason behind its crashes. This scenario usually happens when there is a minting event of a hyped NFT project, where some unscrupulous participants spam the network with bots to be able to buy NFTs before others can.

This is one of the ‘side effects’ of having a flat fee of $0.00025 per transaction. It simply makes it cheaper to launch bots. There are, however, solutions being worked on regarding this matter.

Less Decentralized

Solana is allegedly on the low-end of the decentralization spectrum.

Why allegedly? Because there are too many factors and nuances involved in this topic that it would be disingenuous to speak in absolutes. While the general consensus is something like “Solana is less decentralized than Ethereum, but not really centralized”, take it with a grain of salt. Let’s explore why.

Firstly, it’s quite expensive to run a Solana validator node. You’ll need at least a CPU with 12 cores / 24 threads and 128 GB RAM minimum. But for full functionality, you need to raise that to 16 cores / 32 threads and 256 GB RAM (possibly more). For full info, check out the system requirements. In theory, if it’s harder for average people to run a validator node, then there will be fewer validators, which makes a blockchain less decentralized.

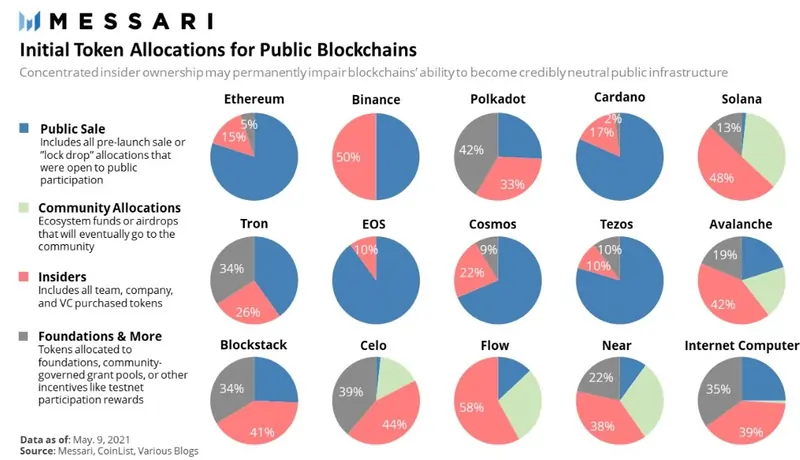

Second, most of Solana’s token supply is allocated to insiders and the Solana Foundation. Check below.

This means that a large percentage of tokens are controlled by either the Foundation or its investor network, giving them a lot of influence over the network. In fact, if you check SOL’s supply, you’ll find that roughly 30% of its coins haven’t even been distributed yet.

Looking at these data, it may be easy to categorize Solana as centralized, but the truth is more likely not that cut and dried.

What are the Top Projects on Solana?

Currently, NFTs are the hottest sectors in the SOL sphere, with collections claiming their bluechip spots such as DeGods, Degenerate Ape Academy, Solana Monkey Business, and more.

DeFi projects in the ecosystem also prove to amass high demand as these platforms leverage the protocol’s secure and scalable foundation, which are much-needed features for financial services.

Apart from NFTs and DeFi, other interesting web3 projects are also rising within the network, with high-potentials to disrupt the markets they are serving.

Solana NFT Projects

Degenerate Ape Academy

Degenerate Ape Academy (DAA) is one of Solana’s most successful collections, with one of its apes purchased for $1.1 million last year. DAA also serves as one of the main attractions at blockchain’s upscale physical store in Manhattan, giving users a physical extension of SOL’s growing universe.

DeGods

DeGods, living up to its godly name, is one of today’s sought-after NFT collections in Solana. In fact, even SOL co-founders Anatoly Yakovenko and Raj Gokal hold one of these blue chip assets. Even Magic Eden co-founder Sidney Zhang was caught by the godly bug.

Moreover, DeGods is descending deeper into the sports realm with its recent purchase of the basketball team Killer 3s for $625,000. (Note: The collection’s DAO made this purchase.)

Solana Monkey Business (SMB)

Solana Monkey Business is the first-ever NFT collection in the protocol to have reached a selling price of $2 million, which speaks volumes about its potential. SMB also arguably sparked SOL’s rise as a prime platform for NFT creation and trading.

Okay Bears (OKB)

Okay Bears is one of the rising web3 brands in the Solana NFT arena. Holders can enjoy exclusive access to its marketplace, where they can choose from a wide range of cool products, including collectibles, merch, and prints.

Moreover, it will soon roll out physical stores to provide more people a chance to know its brand and message better.

y00ts

y00ts, formerly known as Duppies, was created by the same legendary team behind DeGods. But while they have the same creators, y00ts is intended to be a separate collection from its bluechip brother.

One of y00ts’ top offerings includes Scholarship, a unique whitelist selection process aimed at bringing the most deserving people who can provide real value to the community. Moreover, it also offers intellectual property solutions and a marketplace where holders and artists can converge.

NFT Marketplaces

Magic Eden is currently the top NFT marketplace in Solana, according to data and analysis company DappRadar. Its closest competitor happens to be OpenSea, which is currently the world’s largest NFT marketplace overall.

When Solana on OpenSea was launched, so did the trading volume of Solana NFTs, which indicates that Ethereum users have started buying them. However, we have yet to see OpenSea replicate its success in a different environment other than Ethereum considering most of Solana’s NFT volume still happens on ME.

Another newly popular marketplace is Yawww, by the way, became controversial lately with its decision of eliminating royalty fees from NFT artists. While it’s not yet clear if this policy could last, the web3 space’s response could potentially decide the fate of this “0% royalty fee” rule.

But while Magic Eden, Yawww, and OpenSea are the hottest NFT platforms in protocol right now, there are actually more that are also building. You may also check out promising platforms such as SolSea, DigitalEyes Market, and more from this list.

Solana DeFi Ecosystem

Solana is not only a place for NFTs but also a hub of DeFi platforms that provide web3 natives with plenty of options to access financial services. Let’s explore some of the top-performing DeFi projects in SOL and see what these services have to offer.

Serum

It currently ranks as the number one DEX on Solana. This DeFi service is fast, cheap, and features a 100% trustless and transparent platform. Check out our Serum article here.

Raydium

It allows users to swap, trade, earn yield, participate in pools, and join project launch pads.

Solend

Users can tap over 50 assets spread across 32 pools and help them borrow and earn interest in the fastest and cheapest way.

Lido

It allows users to stake for rewards, mint staked tokens, use its tokens as collateral for lending, and participate in its DAO. Plus, users also have the privilege to remain liquid in the platform while staking their SOL tokens.

Should You Invest in SOL?

It depends on your reason for investing. A lot of newbies come to the blockchain/web3 space with the wrong assumptions, which is why some of them get burned. If you have serious plans of getting into Solana, whether you want to launch a project or use some of the protocols and tools available in its vast ecosystem, then yes, it only makes sense for you to actually invest in SOL. You’ll need it anyway.

But if your intention is to speculate that the price may go up, then that’s a different story. Many have made fortunes through Solana and other cryptocurrencies, but there are tragic stories as well. Therefore, we advise you to be cautious and extremely recommend you do your own research and due diligence before investing in the protocol.

How to Buy SOL

You won’t find trouble buying SOL as it is available on most crypto exchanges like Binance, Coinbase, FTX, Gate, and many more. You will, however, need to create an account.

Staking SOL

Staking SOL allows you to earn interest based on the amount staked while also contributing to the security of the Solana network. By delegating your tokens to validators, you are giving a signal to the network that you trust them. This works in a shared risk-reward scenario where both validators and delegators (you) have aligned financial incentives.

The higher your staked amount, the higher the rewards will be.

Staking SOL is fast and easy as you can do it directly on your wallet. To begin, check out either our Phantom staking or Solflare staking sections.

Join our newsletter as we build a community of AI and web3 pioneers.

The next 3-5 years is when new industry titans will emerge, and we want you to be one of them.

Benefits include:

- Receive updates on the most significant trends

- Receive crucial insights that will help you stay ahead in the tech world

- The chance to be part of our OG community, which will have exclusive membership perks