Chances are that you’ve heard of non-fungible token (NFT) platforms with automated market makers before. You might be wondering, what makes them different from a typical NFT marketplace. Here’s what you need to know:

An NFT AMM is a platform that allows traders to instantly buy or sell their NFTs through liquidity pools. It is a type of marketplace powered by an AMM, a mechanism that automatically sets prices for assets based on supply and demand.

AMMs are primarily used by decentralized exchanges (DEXs) such as UniSwap and PancakeSwap to facilitate near-instant token swaps. This algorithm succeeded in boosting the sales of various tokens, but it turns out that it can also be implemented on NFTs to solve liquidity problems.

Today, an increasing number of NFT marketplaces have integrated AMMs into their platforms to leverage the feature’s liquidity-boosting capabilities. These platforms intend to adopt AMMs in order to help traders unlock the true value of their digital assets. But despite their high potential, AMM NFT platforms are still in their early stages; hence, it is important to learn as much about them before taking the leap.

In the following sections, we will discuss how an AMM for NFTs works and why they may serve as a complementary feature (if not an alternative to today’s marketplaces).

How Do AMM NFTs Work?

AMM marketplaces allow you to create liquidity pools with pairs consisting of your chosen NFT and the marketplace’s supported token (e.g DeGods/SOL pool or Azuki/ETH pool). The advantage of having an AMM feature is that you don’t have to wait for somebody to eventually agree to your price. You can sell your NFTs instantly and earn trading fees from your pool!

But as with any good deal, there is always a catch.

NFT AMMs VS NFT Marketplaces

With AMMs, you won’t be able to set the price you want for your NFTs; instead, an algorithm called ‘bonding curve’ will handle this job and price them based on their current supply (against demand).

This means that the algorithm may sometimes set prices for your NFTs below the floor, which would prevent you from fully recouping your initial investment.

Does it mean that AMM can be bad for you? Not necessarily; if you know when to use it.

AMM NFT and traditional NFT marketplaces serve different purposes, and the market definitely needs both types of services.

In case you need to sell your NFT instantly, you can list it in an AMM NFT platform, even though you might sell it below the floor price. This solves an NFT’s liquidity problem but is better suited for floor NFTs (commons).

But if you’re not in a hurry to sell and are willing to wait for a buyer to agree on your price, then traditional NFT marketplaces are your go-to platform. You may wait for a while, but you have the power to set the price you want for your NFTs. This method is ideal for liquidating rare pieces of an NFT collection, say, a mythic, since these are usually valued several multiples above the floor price.

It is in the NFT community’s best interest for these two types of NFT platforms to coexist so they can offer collectors the best of both worlds.

How to Create an AMM NFT Pool

To create a liquidity pool that can generate transaction fees, you must select a pool that can both buy and sell NFTs. After that, you must set your pool configurations, such as your ideal pool fees, NFTs’ starting price, bonding curve, and delta.

‘Bonding curve’ will be your pool’s price mechanism, while ‘Delta’ will determine the size of price changes every time a trade happens in your pool.

Our previous in-depth reviews on AMM NFT platforms such as SudoSwap, HadeSwap, and CoralCube revealed that creating an NFT/crypto liquidity pool isn’t as intimidating as it sounds. And since these platforms share an almost similar user experience (UX) in pool creation, picking one of them as an example should give you an idea of how AMM NFT works on other platforms.

To guide you in creating an AMM NFT liquidity pool, let’s use the Ethereum-based SudoSwap as an example.

Getting an NFT

You will need to have a MetaMask wallet and some ETH to purchase an NFT and cover gas fees.

Link Your Wallet

Just like buying and selling NFTs, you have to link your wallet first on an AMM NFT website before you can create a liquidity pool.

Note: Before connecting your wallet, be sure to top-up your account with enough funds to cover your NFT purchase and gas fees. Moreover, check if the platform supports the wallet you’re using.

Purchase an NFT

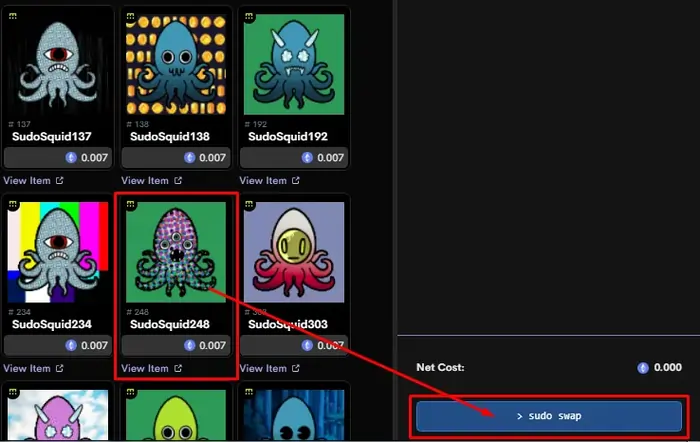

Before providing liquidity for a specific project, you must first purchase an NFT from its collection. For this guide, we selected the ‘SudoSquid’ and picked ‘SudoSquid 248.’

After clicking your preferred NFT, click the ‘Sudo Swap’ button at the lower right of the screen.

Note: On some AMM NFT platforms, not all collections offer liquidity pools. You can identify such collections if they lack a ‘Pools’ tab or any pool-generating options on their page. Furthermore, in case your purchased NFT does not appear in your wallet, please disconnect and reconnect your wallet on the website.

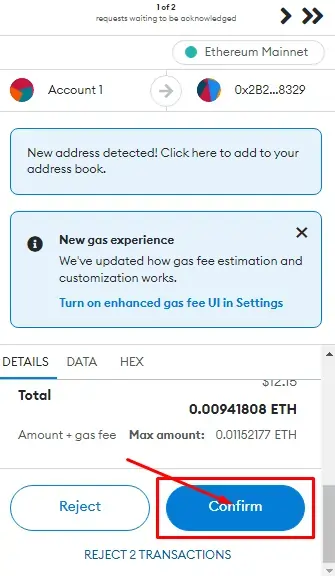

Approve the Wallet Transaction

To finish the purchasing process, click the ‘Confirm’ button on your wallet and wait for the success notification.

Create a Liquidity Pool

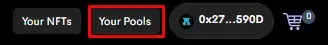

Click ‘Your Pools’ Tab

To start creating your liquidity pool, select the ‘Your Pools’ tab on the upper right screen.

Once clicked, the ‘Create New Pool’ button will appear. Select it.

Choose the ‘Buy and Sell’ Pool

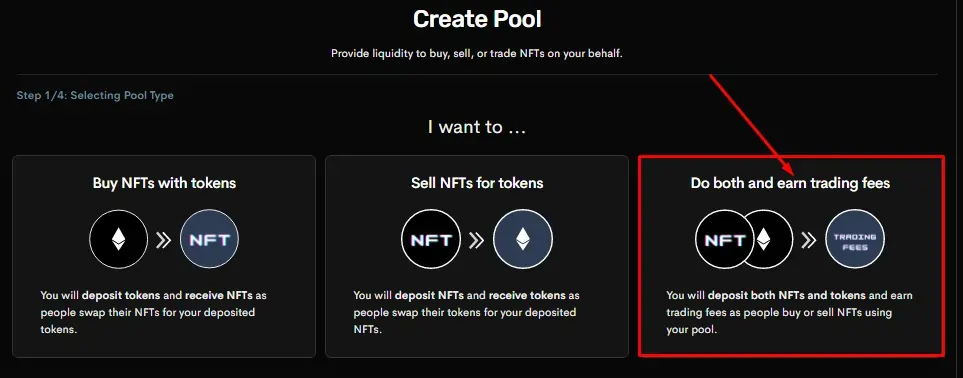

AMM NFT platforms offer three types of pools: The first one allows you to buy NFTs with cryptocurrencies, while the second pool works the opposite way, which lets you sell NFTs in exchange for cryptos.

But if you want to do both and earn trading fees from your liquidity pool, you must select the third type of pool.

Customize Your Pool

Set Configurations

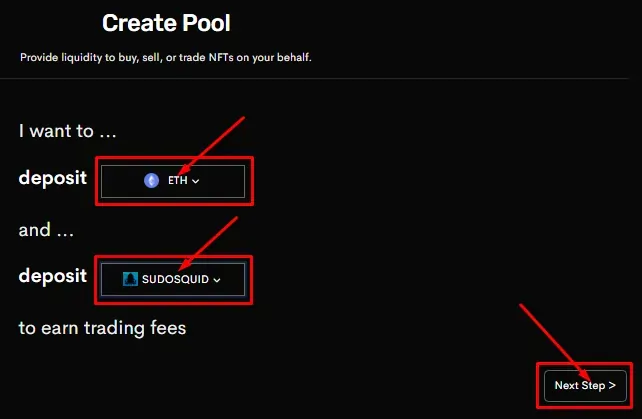

Setting configurations is probably the trickiest part of creating a liquidity pool, but don’t worry; we’re here to make it easy for you. To start creating your pool, indicate what type of cryptocurrency and NFT asset you’ll be depositing into your pool.

After finishing the first part of the configurations, click ‘Next Step’ at the bottom right screen.

Let’s now proceed to the second part. Here, you will be required to adjust your ‘Fee Amount,’ ‘Start Price,’ ‘Bonding Curve,’ and ‘Delta.’ Moreover, you must also indicate how much NFT you will buy and sell for your liquidity pool.

Here’s what each configuration means:

| Fee Amount | How much percentage will you charge for your liquidity pool’s users. |

| Start Price | The starting price for all of your digital assets. |

| Delta | How much price adjustment will happen in your pool every time a trade happens. In our example above, we set our Delta by 0.9 ETH. This means that every time we purchase an NFT, our NFTs’ price will go down by 0.9 ETH. While every time we sell, our assets’ price will go up by 0.9 ETH. |

For bonding curves, AMM NFT platforms usually offer two types of pricing mechanisms. Here’s how each type can affect your pool.

| Linear Curve | The price changes in your pool fluctuate by a flat amount. These changes may not be drastic but predictable. |

| Exponential Curve | Your NFTs’ price can increase and decrease very fast. Be cautious about selecting this type of bonding curve. |

Review Configurations

AMM NFT services usually give you an overview of the configurations you’ve made. Take time to review all these adjustments.

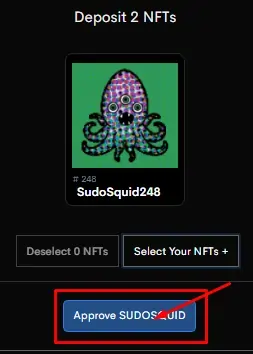

After closely examining your configurations, click ‘Select Your NFTs’ and approve the NFTs you will deposit.

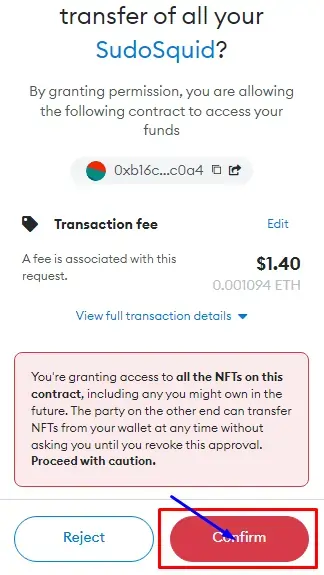

Approve The Wallet Transaction

Click the ‘Confirm’ button and wait for Etherscan’s notification to confirm your transaction’s success. This notification will usually slide out on the right side of your screen.

Promising AMM NFT Platforms

Now, let’s explore the promising AMM platforms for NFTs that we know so far:

SudoSwap

Blockchain: Ethereum

Accepted Wallets: MetaMask, Binance Smart Wallet, WalletConnect

SudoSwap is an AMM NFT platform that allows you to pay 0% royalty fees and only charges 0.5% on its transaction fees.

You can use it to instantly sell your digital assets by creating liquidity pools and generating trading fees from them. With these features, you no longer have to wait for a potential buyer to purchase what you have listed.

It offers three types of liquidity pools to accommodate your different NFT trading needs.

The first one allows you to buy NFTs with cryptocurrencies, while the second pool lets you sell NFTs for cryptos. The third type of pool combines the previous two pools and allows you to charge your desired trading fees and adjust other critical configurations.

Note that you can always use SudoSwap as a traditional NFT marketplace to buy and sell decentralized assets.

HadeSwap

Blockchain: Solana

HadeSwap is an AMM NFT platform and NFT marketplace that offers a 0% charge for both platform and royalty fees.

But some developments will happen soon on the platform, including the implementation of a 0.5% platform fee and the option to pay royalty fees. You can choose from one of these three pools to enhance the liquidity of your digital assets.

The NFT trading service also clarified that it has yet to be audited and reminds users to use its features, including its liquidity pools, with caution.

CoralCube

Blockchain: Solana

CoralCube is an AMM NFT, a traditional marketplace and aggregator rolled into one platform.

It recently partnered with Magic Eden and 13 NFT projects to test the potential of liquidity pools for traders. But now, you can find more NFT collections inside the platform that offers liquidity pool creation, but note that not all projects within CoralCube offer this feature.

Just like the two previous AMM NFT platforms, it also offers three pools to sell your NFTs instantly. When it comes to royalty fees, you cannot adjust them according to your liking, but you have the option to pay them (or not).

Moreover, in CoralCube, liquidity pools that can generate trading fees are called ‘double-sided pools,’ a term not used by SudoSwap and HadeSwap.

Join our newsletter as we build a community of AI and web3 pioneers.

The next 3-5 years is when new industry titans will emerge, and we want you to be one of them.

Benefits include:

- Receive updates on the most significant trends

- Receive crucial insights that will help you stay ahead in the tech world

- The chance to be part of our OG community, which will have exclusive membership perks