On a strawberry moon on the 14th of June, a novel concept that initially originated from the Solana space has sparked heated debates between various platforms, developers, and users across the entire NFT sector. Zero creator royalties for NFTs have essentially become one of the most controversial topics being tackled in the space, as its repercussions are starting to be felt by creators.

And safe to say, the Yawww marketplace is right in the center of it all. Call it what you want — disruption, innovation, democracy, destruction, cancer; but one thing is clear. Yawww has opened Pandora’s box, so to speak.

“Your NFT, Your Choice”, it said.

Essentially, it has built a platform that allows users to change the royalty mechanism set by founders, and sell their NFTs at a percentage of their choice. For instance, if I list a Trippin’ Ape Tribe NFT on Yawww, I basically have two choices. Either go with the default 10% royalty set by Valhalla Labs (Trippin’ Ape team) or set it lower (or higher). I can even set it to 0 if I’m feeling greedy.

If you were in my place, what would you do? For some NFTs that trade north of $10K, sellers could save at least $1K if creator royalties are eliminated. Once this type of scheme hits the Ethereum NFT market (it probably already has), some creators could potentially lose several thousands for every sale.

Yawww and its campaign were initially met with a lot of flak, especially from NFT founders who recognize the monumental ramifications zero-royalty could pose not only to the Solana space but the entire NFT industry. But as time went by, the market appears to be moving towards this new trend, as the number of users trading on these “alternative NFT marketplaces” is continually increasing.

But why would Yawww do something like this? Is this a race to the bottom, where a platform is desperately trying to squeeze as much liquidity that’s left in this dreaded bear market by undercutting its competitors and possibly hurting its long-term sustainability? Probably not. However, it seems that it is betting everything on the chance that this is the right way for the industry to move forward.

Well, is it?

It better be. Otherwise, there is no telling how the space could survive.

How to Bypass NFT Artist Royalties

The zero-royalty phenomenon came out of Solana, but it applies to every NFT in every blockchain. On Solana, NFTs are powered by a standard created by Metaplex. Every other chain has its own set of tools and standards for how NFTs are designed, but like Metaplex, they typically hard-code a royalty mechanism in the smart contracts, which will automatically be enforced by NFT marketplaces that follow the said standard.

This enabled perpetual royalty schemes, where artists and founders could continually make a living through the secondary sales of their works. On a side note, this was the “aha moment” for most NFT founders, which is likely the reason why many are heavily opposing its circumvention.

But you can actually bypass creator royalties by simply trading peer-to-peer (P2P). In essence, this is a trading setup where two parties agree to a trading deal. For example, you send a Stoned Frogs NFT to my wallet, and in return, I’ll send you 5 SOL. Since we exchanged it by ourselves and didn’t use a marketplace that subscribes to the Metaplex standard, none of us have to pay royalties to the original creator — the Stoned Frogs team.

But the above example only applies to friends and family; people you trust. And that setup accounts for substantially less than 1% of all NFT sales in the market. That is, until P2P platforms like Yawww and FoxySwap popped up to provide users the ability to create and negotiate deals with people they don’t trust, which has effectively scaled P2P trading across Solana.

However, even that wasn’t enough to truly spark a debate until Yawww upgraded its platform to become a full-blown NFT marketplace that utilizes its P2P mechanism. This caused all the rage and turmoil amidst the already-depressed NFT market.

Yawww happens to have a strong community of supporters, as well, who have praised its stance of “democratizing NFTs”. In fact, many are also speculating that Yawww could potentially rival if not unseat Magic Eden as the number one NFT marketplace on Solana. If the vast majority of NFT traders migrate to Yawww, then it will tip the scales over to 0% royalties.

Other Solana marketplaces are not waiting on the sidelines either, as many have adopted a similar mechanism, likely to attract more users. But it remains to be seen whether this is sustainable long-term. Solanart even allows its users to set its marketplace fees (not to be confused with creator royalties) to 0.

Why Most NFT Projects are Against 0% Royalties

Perhaps the most outspoken critic of this new paradigm brought by Yawww is FrankDeGods, the lead creator of Solana’s most successful NFT collection by far, DeGods. This is a vital detail because Frank happens to be one of the most respected builders on Solana, and his brand reach extends even into Ethereum circles, thanks to the commercial success of the DeGods collection, and the hype surrounding his team’s new project, Y00ts.

Had Frank accepted Yawww’s 0% royalty with open arms, there probably would be less antagonism from the opposing camp, and more projects would probably be forced to roll over and adapt to this new paradigm. However, Frank has refused to acknowledge it for a logical reason. Royalties are the primary revenue source of DeGods and a lot of our projects.

I don’t mind getting sh$t for defending creator royalties. I know I’m speaking for thousands of creators that feel helpless.

FrankDeGods

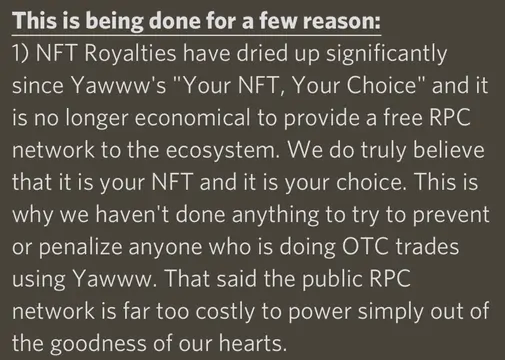

The repercussions of zero royalties are starting to creep in. Recently, Shadowy Super Coders had to abolish their free RPC nodes, which has been a major solution to the congestion issues on Solana. This is due to many of its holders listing their SSC NFTs on zero-fee marketplaces, which has massively affected its secondary revenue.

FrankDeGods also believes that royalties are currently the “best alignment of incentives” between NFT creators and holders. And without it, he fears that the end result would cause mints to become more expensive and rug pulls to increase, among other “bad news”.

But after a few months of fighting for creator royalties, the DeGods team finally decided to pivot to zero-percent royalties for both the DeGods and Y00ts collections. FrankDeGods states that he still believes in the benefit of giving creators a commission for every NFT trade, but for now the project needs to adapt.

Cets on Creck developer Peblo, who is less critical on the subject, has also questioned the legal implications of removing creator commissions, drawing parallels to the music industry, where people who download pirated music files from unscrupulous sites are subject to lawsuits.

The Rise of Zero-Royalty NFT Marketplaces

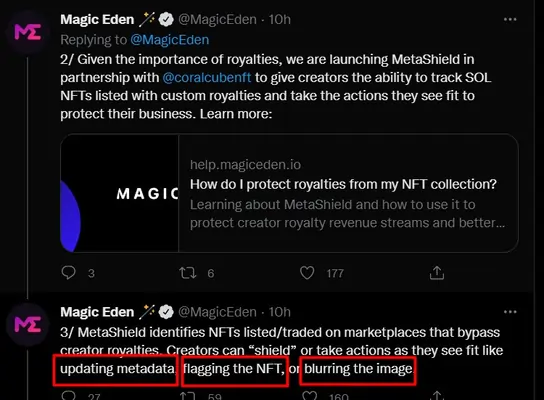

Yawww is no longer at it alone. There are now several NFT marketplaces on Solana that allow users to set custom royalty percentages. Even Coral Cube, the marketplace responsible for creating the anti-zero-royalty tool, Metashield, has now fully embraced zero creator fees.

Solanart, which was once the leading marketplace, took things a step further by not only allowing custom royalties but also marketplace fees. This means that users can truly earn 100% of their NFT trades if they set both parameters to 0. The sustainability of Solanart’s model is questionable at best, considering the costs of maintaining an NFT trading platform.

To be updated. We will soon cover other platforms like NFT AMMs following its models such as X2Y2, SudoAMM (Ethereum marketplace), and others. Bookmark this.

Proposed Solutions to Zero Royalties

There are problems and there are solutions. The web3 world is filled with brilliant builders and visionaries, which is why we, at Metaroids, are confident that the industry will somehow find a way to pull through. And I dare say that after we get past this royalty issue, the NFT space will come out stronger and bring even greater value to the world.

This list is by no means complete. We may have missed a few solutions (let us know). But it is what we have compiled so far (to be updated).

Decrease Creator Royalties

One solution projects can easily implement today is to simply decrease their royalty cut. Many collections set royalties around 5-10%, some even go as high as 15%. This is one of the arguments raised by those in favor of 0% royalties, as some projects are just borderline abusive.

NFT influencer and Okay Bears whale Nate Rivers recommends marketplaces take a mere 1% fee while limiting creator royalties to 2.5-5%, which, frankly, isn’t that low. Yuga Labs was able to build the most successful NFT collection to date — Bored Ape Yacht Club, with a mint price of less than $200 and a royalty rate of 2.5%.

Many collections have already expressed their intentions to decrease royalties. If more projects do this, maybe holders may not opt to trade on p2p marketplaces.

Flag NFTs Listed on No-Royalty Marketplaces

A harsher approach would be to penalize holders that list NFTs on zero-royalty marketplaces as a deterrence. This can be done in multiple ways. For DeGods’ case, it plans to block the NFTs from participating in its $DUST staking mechanism, among other holder benefits.

Basically, holders have to choose whether to respect the wishes of their founders and enjoy all the provided utilities or use platforms that bypass creator royalties and face the consequences.

However, this is also a double-edged sword since punished buyers/sellers might lash out and discredit creators on social platforms, which is bad publicity (something that projects avoid at all costs). This is why many view this as a band-aid fix than a real solution.

Build a Loyal Community

Ultimately, if no technical solution arises, creators will need to accept the fact that they can’t prevent anyone from bypassing the royalty scheme technologically. One way NFT collections can thrive in such market dynamics is to simply inspire loyal holders who want to support them despite the fact.

After all, many consumers purchase products from social enterprises because they want to support their causes. The same can happen with NFT projects as holders are usually incentivized to help their creators thrive, but it would take a loyal community to pull this off.

Implementing Harberger Taxes

A more radical solution would be the implementation of the Harberger tax for NFTs. The idea was initially introduced by University of Chicago assistant professor of Finance Anthony Lee Zhang in a podcast last April 2021, and was recently given the stamp of approval by two layer-1 blockchain founders — Vitalik Buterin (Ethereum) and Arthur Breitman (Tezos).

In a Harberger tax system, holders would set the ‘fair value’ of their NFTs and pay a fraction of that periodically in perpetuity. That way, owners are incentivized to price their NFTs proportional to the value they are willing to pay to keep them. And original creators can gain exposure to their works forever regardless of whether they are being traded or not.

You might be thinking “wait what?”. Yes, you have to pay a fraction of the value you set forever. Otherwise, you’ll potentially lose your NFT to someone who will. But the concept of paying taxes for something you already own might be too novel to easily be accepted as the norm.

There are ways to get around this though, but the Harberger tax scheme needs to be optimized in a way that the majority can accept.

Find Other Revenue Streams

If all else fails, survival will come down to a creator’s ability to fund development through other means.

Let’s explore that in the next section.

NFT Projects That Thrive Without Reliance on Royalties

Not every project needs perpetual royalties to maintain operations.

CryptoPunks

The CryptoPunks collection is one of the first-ever NFTs launched on Ethereum, showcasing 24×24 pixelated humanoid characters that sport various eclectic attributes like clothes, accessories, etc. It was created by Larva Labs, who distributed the collection in June 2017 by handing them out to multiple Ethereum users for free.

CryptoPunks’ saving grace was when tech media Mashable released an article that triggered a buying frenzy that allowed Larva Labs to pioneer most of the tactics still being used today (community building through Discord and Twitter, releasing new collections, etc.).

Larva Labs was able to maintain operations since the two founders held 1K Punk NFTs themselves, which they most likely sold slowly at premium prices over time. It was also able to generate more sales through the release of new NFT collections like Autoglyphs and The Meebits.

So to recap, CryptoPunks was able to fund operations through new collections. Unfortunately, this business model is difficult to replicate as Larva Labs existed in a time when the market wasn’t as saturated. Many projects have attempted to do the same but failed.

Degen Fat Cats

Degen Fat Cats is the fractionalized NFT collection that runs the Degen Coin Flip gambling site, which was launched in December 2021. While the project has set a creator royalty of 5%, it is not its primary source of revenue. The iGaming site allows users to flip their SOL with a 50/50 chance of either doubling their bets or losing them. The platform makes money by charging 3.5% per flip.

Can Degen Fat Cats survive if it sets NFT royalties to 0? Maybe it can, but it hasn’t been around long enough to give us confidence. Nevertheless, it is a good sign that thriving without reliance on royalties is indeed possible.

ABC

ABC is a project spearheaded by HGE.SOL (founder of The OpenDAO) that boasts an ecosystem and community of open-source builders. It has set royalties to 0 in order to incentivize “pushing the [NFT] space forward and decentralization”. According to HGE, this makes every holder the founder, not just him, and thus, encourages all to work towards a common goal.

While ABC has seen early success since its launch and allegedly has 10 projects building on top of it, it is barely a month old so we’ll have to get back to it in a few months or so.

Conclusion

There are currently not a lot of royalty-free projects in the NFT space right now, but some of them can possibly make it without royalties. Most Solana marketplaces have already followed Yawww’s footsteps in enabling custom-royalty trades. And it appears that it is more than likely that this will become the norm.

Even if it won’t, there is nothing that can currently stop zero-royalty trading technically. The die has been cast.

If you want to be part of the future, come join us.

Join our newsletter as we build a community of AI and web3 pioneers.

The next 3-5 years is when new industry titans will emerge, and we want you to be one of them.

Benefits include:

- Receive updates on the most significant trends

- Receive crucial insights that will help you stay ahead in the tech world

- The chance to be part of our OG community, which will have exclusive membership perks